Landlords in the capital’s prime rental sector are facing a stark choice between topping up a rent shortfall or selling up.

Luxury residential property expert, Jo Eccles, reports that highly leveraged landlords are coming under serious cost pressures as fixed rate mortgage deals come to an end. Stress testing by lenders means some are finding they can borrow 30% less than before, forcing them to make up the shortfall or sell.

The founder and MD of Eccord, which manages £1.5 billion worth of residential property in prime central London for portfolio and individual landlords, says: “Those with the financial flexibility are reorganising their finances to pay down debt and raising rents by an average of 15% at renewal, but it isn’t always enough to meet their increased borrowing and service charge costs – which are up 30% in some buildings.”

One landlord has seen his mortgage repayments more than double from £4,000 a month to £9,000 a month and can’t sell due to cladding issues.

Rent increase

“We’ve secured him a significant rent increase of 19% but he has still swung from a monthly surplus to a £2,000 shortfall, which he’s having to personally top up each month.

“This illustrates that the challenges landlords are facing can’t always be resolved with rent increases alone.”

Some now have no choice but to exit the market which will further diminish supply and cause more hardship for tenants, believes Eccord.

“For landlords who are able and committed to remaining in the market long term, we are seeing them review their existing arrangements,” she adds.

“Many are choosing to move away from underperforming letting agents or property managers with high staff turnover, as they recognise the importance of tenant experience now more than ever, if they’re to achieve high rent increases.”

Original Post from landlordzone.co.uk

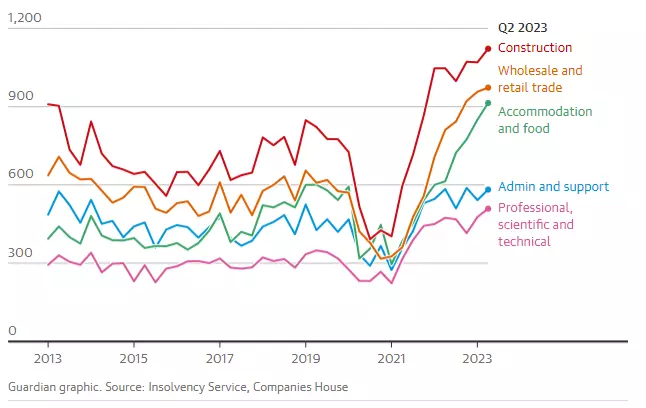

The effects are being felt at the building materials suppliers Travis Perkins and Marshalls, which have both warned of lower profits in recent months.

The effects are being felt at the building materials suppliers Travis Perkins and Marshalls, which have both warned of lower profits in recent months.

Julie Ford, who is a mediator at PRS Mediation, says a female landlord has been in touch with her to ask her for help with a problem and during the discussions revealed she was named as guarantor for her own tenants.

Julie Ford, who is a mediator at PRS Mediation, says a female landlord has been in touch with her to ask her for help with a problem and during the discussions revealed she was named as guarantor for her own tenants.

Blakeway said his special investigation into L&Q found that “resident concerns were repeatedly dismissed or poorly handled, without the respect they or their issues deserved. Crucially, the needs of vulnerable residents were not always identified, and too often this caused serious detriment and risk to them”.

Blakeway said his special investigation into L&Q found that “resident concerns were repeatedly dismissed or poorly handled, without the respect they or their issues deserved. Crucially, the needs of vulnerable residents were not always identified, and too often this caused serious detriment and risk to them”. “This is unacceptable,” he said. “You have stopped listening to your residents’ voices, and failed to deliver the service that they should expect … in some cases you were described as having been ‘heavy handed’, ‘dismissive’ and even ‘callous’ and ‘confrontational’ … You must take immediate action to remedy these severe failings.”

“This is unacceptable,” he said. “You have stopped listening to your residents’ voices, and failed to deliver the service that they should expect … in some cases you were described as having been ‘heavy handed’, ‘dismissive’ and even ‘callous’ and ‘confrontational’ … You must take immediate action to remedy these severe failings.”

Responding to comments by Gove, suggesting a delay to energy efficiency proposals for the private renter sector, Ben Beadle, chief executive of the National Residential Landlords Association, expressed concern.

Responding to comments by Gove, suggesting a delay to energy efficiency proposals for the private renter sector, Ben Beadle, chief executive of the National Residential Landlords Association, expressed concern.