Lock-ups are being reinvented and marketed as more than just storage amid overcrowding and record rent rises.

Forget the gym membership and juicing regime: the new must-have to boost personal wellbeing is a self-storage unit.

At least, that is the call from a new company urging space-squeezed thirtysomething renters to accept that they cannot afford a home with enough cupboards in today’s housing system and instead sweep their clutter into a rented lock-up.

Hold, which is opening five storage sites in London, is trying to persuade householders that spending £270 a month on a lock-up is a lifestyle choice with the potential to “promote feelings of calm and relaxation” and even boost mental health.

The marketing gambit comes as figures show more than 100 storage complexes have opened in British towns and cities in the past three years, and that the sector now generates £1bn a year in revenue. Increasingly, the facilities offer communal areas, hot desking and creative studios to make them a more palatable extension of home.

But the Generation Rent campaign group has now warned that far from being a lifestyle choice that could boost wellbeing, the storage boom should be seen an “indictment of our housing crisis”.

“Self-storage warehouses sprouting everywhere … won’t come close to solving our problems,” said Ben Twomey, Generation Rent’s chief executive. “Homes are the foundations of our lives, so a storage container might be the perfect metaphor for how government inaction is leaving renters out of sight and out of mind.”

New self-storage space equivalent to more than three Canary Wharf towers – or about 6,000 two-bedroom flats – has been opened in the UK in the past year, according to an industry report from the real estate firm Cushman & Wakefield. The sight of storage complexes opening close to small newbuild flats is fast becoming one of the darker ironies of Britain’s struggle to supply enough housing.

This growth in storage sites is being driven by record rises in private rents and increasingly cramped housing; more than 500,000 rented households in England lived in officially overcrowded homes in 2022. The average UK rent increased by 9.2% in the past year, according to the latest figures from the Office for National Statistics, the equivalent of an extra £1,300 a year on the average rent in England.

Overcrowding often means children sharing bedrooms with adults, and sometimes beds with one another; more family arguments; teenagers struggling to do their homework; and damage to physical and mental health, a survey by the National Housing Federation found.

“People are living on top of each other and it’s fundamentally unhealthy,” said the founder of Hold, Frederic de Ryckman de Betz, who said he had previously found homeless people trying to live in units. “Separation is very important.”

Hold tells potential customers: “The system has let us down; leaving many of us feeling trapped as we get outpriced and squeezed out. It’s a fact: less space leads to a lower quality of life. How we feel about our personal and work space is deeply connected to our wellbeing. We all need more room to breathe, live, and grow.”

The location of Hold’s first branch, on a north London street that has been described as the “golden mile” of self-storage owing to the large number of new sites, embodies that system failure. It stands on the boundary of the boroughs of Camden and Islington, where average monthly rents are £2,672 and £2,384 respectively, about double the UK average.

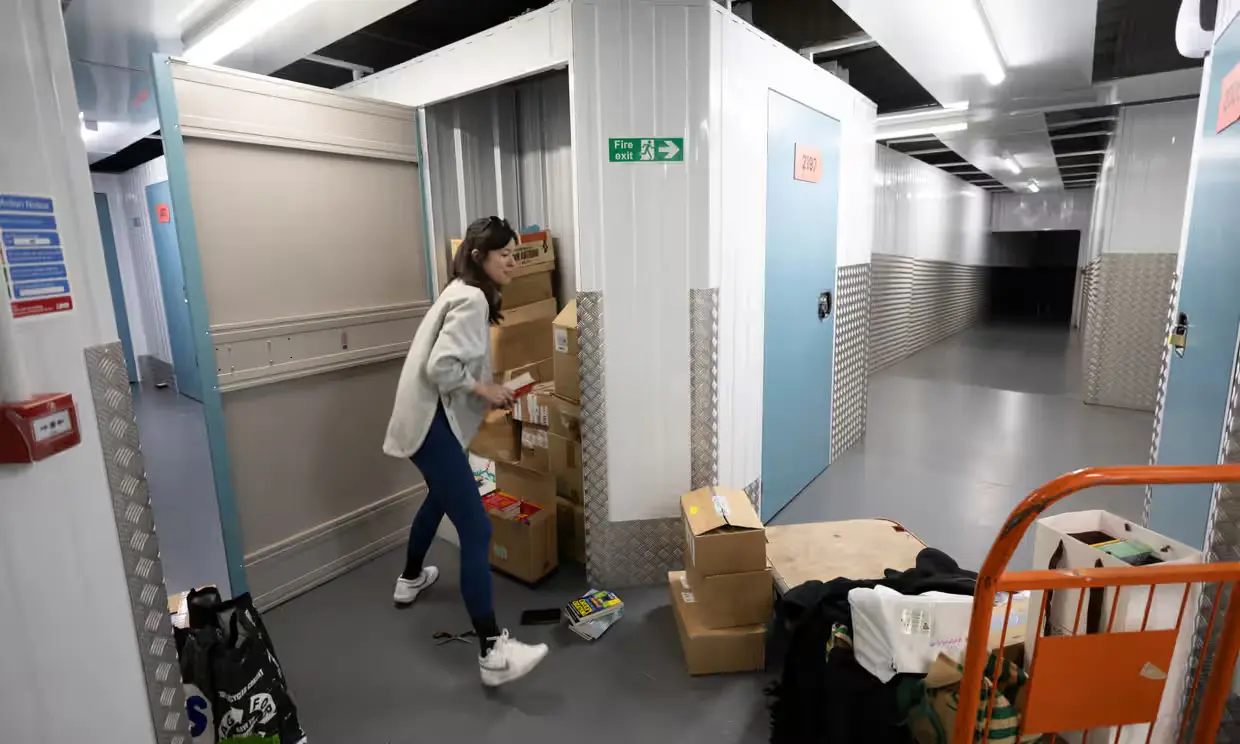

On a visit to its first branch this week, the Guardian found Vincent, a professional drummer, practising in a soundproofed tiny unit because he cannot play in his flat. There was also a woman organising a charity library that had grown too large to store at home.

Hold’s approach appears to be to try to build on the decluttering movement pioneered by Marie Kondo, who argues that tidying up possessions can “reset your life”. It is also fitting hotdesk spaces, wifi and rentable music studios, as customers spend more time at the storage.

Renters at other complexes have previously told the Guardian they are using units as a workshop for a woodworking hobby, as a makeshift library, to run an eBay business, as well as for the standard stashing of surplus clothes and furniture. Some said they got a “punch” of satisfaction from seeing all their possessions in one place, while others said it enabled them to “live tiny” – in a van or even a car.

Despite the push to attract younger customers, most self-storage users are between 50 and 70 and often start because of a need to store inherited furniture and possessions after a family bereavement.

Philip Macauley, the head of self-storage at Cushman & Wakefield, said: “It’s still a middle-aged customer, but [operators] are trying to drive it to millennials. It’s the age-old London problem. Flats are getting smaller and with interest rate inflation you can’t afford a two-bed, you have to get a one-bed, and the flip side of that is [renting] self-storage.”

His report predicted “more lifestyle customers … long-term residential customers who genuinely use their self-storage unit as their room away from home, storing different items at different periods of their life”.

But self-storage is not the solution to the housing crisis, said Twomey. He called on the government to “build more homes, fund councils properly to crack down on landlords profiting from overcrowded rentals, and act to slam the brakes on soaring rents”.

Original Post from theguardian.com