Insulation: Households could save £300 in new insulation scheme

Households could save around £310 a year through an expanded scheme to insulate Britain’s draughtiest homes, the government has said.

It will spend £1bn from next spring on grants for homes that have low energy efficiency ratings and are in lower council tax bands.

Households will need to contact their energy supplier or council to see if they are participating, it said.

But critics questioned why the funding would not be available over winter.

The Department for Business, Energy, Industry and Skills (BEIS) said households who currently did not benefit from any other government support would be able to upgrade their homes under the ECO+ scheme.

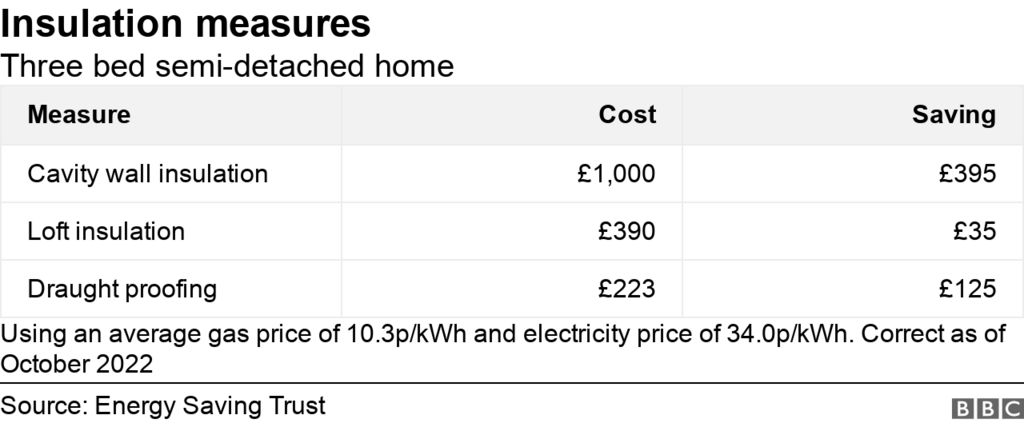

The grants will help households to fund low-cost measures such as loft and cavity wall insulation, with the average cost per household expected to be £1,500.

A new £18m public information campaign will also offer advice on how to reduce energy use in the home, “without sacrificing comfort”, BEIS said.

Some of the government’s tips include:

- Turning the “flow temperature” of your boiler down from 75⁰C to 60⁰C (which is different to turning down your thermostat). It is often done by adjusting a dial on the front of your boiler. It will make no difference to the temperature a room is actually heated to but may mean it takes longer for your rooms to heat up.

- Turning down radiators in empty rooms

- Reducing heating loss from the property by draught-proofing windows and doors

Mr Shapps said the ECO+ scheme would “enable thousands more to insulate their homes, protecting the pounds in their pockets and creating jobs across the country”.

Without insulation, indoor temperatures are difficult to maintain, and homes can lose up to 45% of their heat, according to the Energy Savings Trust.

In a typical three-bedroomed semi-detached house in the UK, the Energy Savings Trust estimates that installing draught proofing measures plus cavity wall and loft insulation could save £555 on an average annual energy bill.

“We’ve spent around £6.6bn on improving millions of homes so far,” Mr Shapps told the BBC. “This is actually a scheme for people who have been left out thus far because their homes haven’t qualified.”

But shadow business secretary Jonathan Reynolds told the BBC the measures were “so late when we should have been doing so much more for so many years previously”.

He also accused the government of a lack of ambition when it came to plans to end the country’s dependency on fossil fuels.

An already existing ECO scheme is targeted at people in social housing, on low incomes or who are fuel poor.

However, under the expanded scheme, people whose homes have an energy efficiency rating of D or below can get help, whether they are in private, rented or social housing. Energy efficiency ratings run from A-G, with A being the best and G the worst.

Applicants will have to live in properties covered by council tax bands A to D, according to reports.

If you are eligible for support, your energy firm will do a survey and pay for the improvements.

Despite targeting middle earners, the government says about a fifth of the new £1bn of funding will be reserved for the most vulnerable households.

Fuel poverty campaigners welcomed the measures but said more needed to be done to help those most in need.

Adam Scorer, chief executive of National Energy Action, said the “scheme is not designed to reach the most vulnerable, it’s designed to reach people who haven’t been able to benefit from previous schemes”.

“We believe government focus should be on the worst first, helping people in the greatest risk, the greatest jeopardy, more of this money should be going to help them.”

UK lags behind

The UK is often described as having some of the oldest and least energy efficient housing in Europe.

Two years ago, BBC research found 12 million UK homes were rated D or below on their Energy Performance Certificates, which means they do not meet long-term energy efficiency targets.

Currently 46% of homes have an energy efficiency rating of C or above, up from 13% in 2010, according to BEIS.

In his Autumn Statement, Chancellor Jeremy Hunt announced a new target, to reduce energy demand by 15% by 2030.

BEIS said this target would be backed by an additional £6bn investment after 2025.

Mr Hunt said the ECO+ scheme would help “hundreds of thousands of people” to improve the insulation of their homes.

Greenpeace UK energy campaigner Georgia Whitaker said nearly seven million homes were suffering fuel poverty, while 19 million homes in England and Wales are badly insulated.

“This is a drop in the ocean compared to what people actually need to stay warm and well this winter and in the winters to come,” she said.