Insolvencies rocket as army of small firms – seen as backbone of the sector – struggle with falling demand, rising interest rates and higher costs.

It’s tough out there,” says Steve Midgley, the managing director of Fairgrove Homes. His east Midlands firm, which builds about 50 homes a year, is one of Britain’s army of small housebuilders that are struggling with falling demand, rising interest rates, labour shortages, and high material and wage costs.

“It’s taking longer for people to sell their own house,” says Midgley. “So it’s taking vastly longer to exchange contracts. After the reservation, we’re talking three or four months, whereas at one time we’d have had that down to four to six weeks. And that all puts stress on the working capital, the work in progress and everything.”

Cracks in the housebuilding market – a key barometer of consumer confidence – are growing by the day. Barratt Developments, one of the largest housebuilders in the UK, recently said it would build 20% fewer homes this year. Taylor Wimpey, another big builder, has said the share of its first-time buyers taking on mortgages of more than 36 years has almost quadrupled since 2021 to 27%.

Cameron Homes, a family-owned firm based in Staffordshire, is offering discounts and free extras, such as carpets and upgrades, to persuade hesitant buyers.

“We are having to negotiate with purchasers,” says Kate Tait, the firm’s land and planning director who previously worked at the much bigger builder Persimmon. “People are taking quite a lot longer to commit to the purchase of a house because of the uncertainty around what it’s going to cost on interest rates. Not just for the first two years, but what’s going to happen beyond that.”

The Bank of England’s sharp hike in rates since December 2021’s record lows – increasing them to a 15-year-high of 5.25% last week – has sent shockwaves through the housebuilding industry.

Midgley says: “People are much more risk averse and they want to see a house nearly finished before they commit. In the last few years we’ve been selling plots at a very early build stage and in some cases before they were started and that has been a real shift change.”

House prices across the UK fell at the fastest annual pace in 14 years last month, the Nationwide building society said recently. Prices have declined by 4% since the peak last summer, and economists say they have further to fall. However, a full-blown housing crash – during which prices fall by 20% or more – looks unlikely to happen, with unemployment low and more people on fixed-mortgage deals than during the financial crisis.

The downturn has forced the big housebuilders to drastically scale back their projects and land-buying, and sales and profits have taken a big hit. Barratt is on course for a double-digit fall in annual profits, while Taylor Wimpey’s are expected to halve.

Cameron expects to deliver between 200 and 220 homes this year, down from the 250 to 300 it usually builds in a year. But Tait says newbuilds are still popular as they are cheaper to run, with lower energy bills and fewer home improvements needed than older properties.

Midgley says: “We still have demand. As always, good locations are key and correct pricing.” Fairgrove’s biggest project is at a former brewery site in Kimberley, Nottingham, where a two-bedroom apartment costs £195,000.

According to Aynsley Lammin, a building analyst at the banking and wealth management group Investec, the total number of UK homes completed in 2023 could be down by 25% on last year’s figure of 177,400 before recovering slightly to 135,700 in 2024.

He expects “this downturn to be very painful but not as bad as during the financial crisis of 2007-08”, when housebuilding slumped 40% from peak to trough and prices fell by 20%.

The latest housing downturn will feed into weakness in the wider economy. Housebuilding is worth about 3% of the UK’s economic output and Charlie Campbell, an analyst at stockbrokers Liberum, expects newbuild completions to fall by about 20%, resulting in a 0.6% hit to gross domestic product this year – with smaller firms feeling the pain more than bigger ones.

“The big builders in the UK have got lots of cash on the balance sheet,” he says. “Smaller builders tend to run for debt and they have the problem that debt’s costing them more and more and is probably less and less available. The other problem is that the large ones have lots of land. Therefore, delays are not a huge problem. But for some of the smaller ones planning and other delays really make it pretty difficult.”

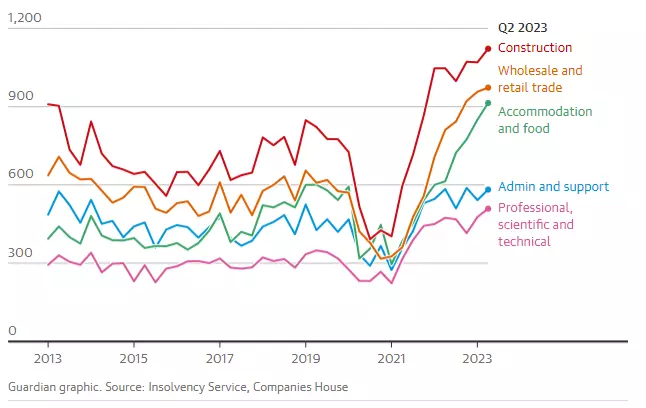

While the large builders dominate the headlines, Britain’s 342,000 small and medium-sized construction firms are regarded as the backbone of the industry. The problems are mounting: construction has had more insolvencies than any other sector in the past year and accounted for almost one in five of all business failures in recent months. Between April and June, 1,122 construction firms went bust, the most since spring 2009, according to the Insolvency Service.

The construction industry suffered more insolvencies than any other sector in April-June 2023

Quarterly insolvencies in England and Wales, top five sectors

The effects are being felt at the building materials suppliers Travis Perkins and Marshalls, which have both warned of lower profits in recent months. Marshalls is making further job cuts and is closing a factory.

The effects are being felt at the building materials suppliers Travis Perkins and Marshalls, which have both warned of lower profits in recent months. Marshalls is making further job cuts and is closing a factory.

Nick Roberts, the chief executive of Travis Perkins, says: “We’ve seen some customers hold back because they are concerned about their mortgage rates. They are just not confident to press ‘go’ on a home improvement project.”

The cost of building materials rocketed after Russia’s invasion of Ukraine in February last year, but has eased in recent months. Prices for timber and steel are falling, but those for concrete and related products are still rising.

The number of small housebuilders has plummeted from about 12,000 in the 1980s to just over 1,000 today, according to the Federation of Master Builders. Back then, it took six to eight weeks from submitting a planning application to getting the first spade in the ground, according to Steve Morgan, who founded the housebuilder Redrow as a small firm in the 1980s. Today, it takes months or years until everything is approved.

Jennie Daly, the chief executive of Taylor Wimpey, describes the planning system as “extremely challenging”, saying that while requirements for housebuilders have become more complex, local authority planning resources have more than halved since 2010.

The UK has long had a housing shortage as the population has grown faster than homes have been built, sending rents and house prices soaring. According to the Centre for Cities thinktank, the housing market is missing 4.3m homes that could have been built since the 1950s, but were not because of outdated planning regulations.

Tait thinks the planning system is too politicised. “In the UK, it’s become such a political hot potato, the location of new housing, that we’re simply failing to deliver anywhere near the amount of housing that we need,” she says.

Shortages of bricklayers, plasterers and other construction workers – caused in part by Brexit and an ageing workforce – have also hampered the sector. The government recently added them to its “shortage occupation list”, making it easier for foreign builders to come to Britain.

“It’s a year too late. We needed that a year ago. They’re doing that just as people are slowing down,” says Midgley.

Original Post from theguardian.com