For the property market, there are strong parallels between January and September this year, according to Knight Frank.

The number of sub-4% mortgages is growing as financial markets bet on multiple rate cuts over the next year as inflation is tamed. It was a similar story in the early weeks of 2024.

Knight Frank’s head of residential research, Tom Bill, points out that the catch last time was that underlying inflation did not come under control as quickly as headline inflation and any new year optimism had faded by the middle of February.

So, what’s the hurdle now following a 0.5% rate cut by the US Federal Reserve last week and a UK services inflation reading (5.6%) in August that met expectations?

“The snag this time is political rather than economic,” Bill explained. “Uncertainty hangs in the air ahead of the Budget on 30 October.”

He continued: The government has warned it will be “painful” and speculation has focussed on changes to inheritance tax, capital gains tax and pension tax relief among others.”

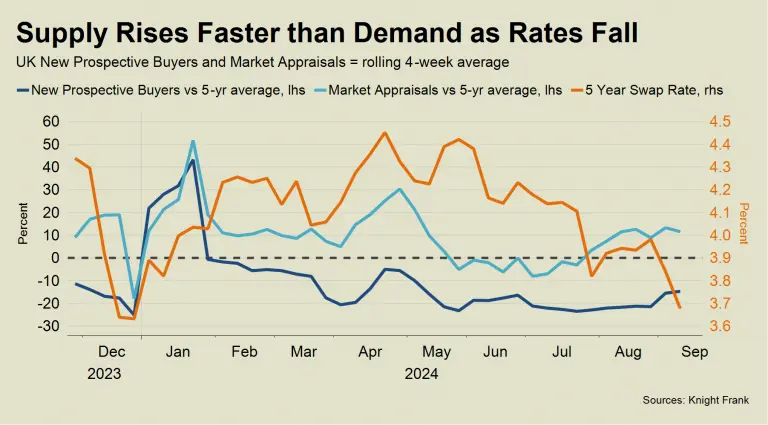

Consequently, buyers are more cautious than they were in January, as the chart shows.

The number of new prospective buyers in the four weeks to 14 September in the UK was 15% below the five-year average, Knight Frank data shows. Meanwhile the number of market valuation appraisals (which are requested by owners looking to sell) was 12% higher.

Furthermore, there was an average of 6.7 new buyers for every new sales instruction in the same period, which compared to a figure of 16 in early January, underlining the strength of demand at the start of the year.

Despite the comparable interest rate outlook, buyers have been slower to come forward in September than January.

“Lenders have brought down their rates ahead of what should be a busy autumn period,” said Simon Gammon, head of Knight Frank Finance, citing the fact that a sub-4% two-year fixed-rate deal was now available. “We just need the property market to respond now.”

One of the reasons that sellers are more active is the possibility that capital gains tax will rise in the Budget from its current level of 24% for higher-rate taxpayers. Some second home-owners and landlords sitting on taxable gains are looking to sell before 30 October.

But Knight Frank does not expect meaningful downwards pressure on prices over the final months of 2024; the agency’s latest UK forecast is 3% price growth in 2024.

Bill added: “Demand has evidently picked up to some extent as rates drop, but sellers should be aware that buyer exuberance will be in short supply, particularly this side of the Budget. People are also still rolling off favourable fixed-rate deals agreed in recent years when rates were low.

“A Budget that is less painful than feared could therefore trigger a relief bounce and higher levels of housing market activity, which would be positive for the whole economy. Each transaction adds £10,000 on average to GDP, estimates from Knight Frank and the HBF have shown.

“It could also have the reverse effect, particularly in higher-value markets.

“Either way, the biggest obstacle – uncertainty – will be overcome in five weeks’ time.”

Original Post from propertyindustryeye.com