Angela Rayner plans to reform Margaret Thatcher’s Right to Buy policy, which allows most council tenants to buy their council home at a discount, to ensure the stock of social housing is not depleted.

The deputy prime minister and housing secretary reportedly plans to slash Right to Buy discounts by two-thirds in an unprecedented attempt to stop council house tenants from buying their own homes.

Under plans to be unveiled in the Budget, the discount of 70% available to those seeking to buy their council house would be cut to about 25%.

At the same time, Rayner is to more than triple the amount of time people need to have lived in their home to qualify, from three years to 10.

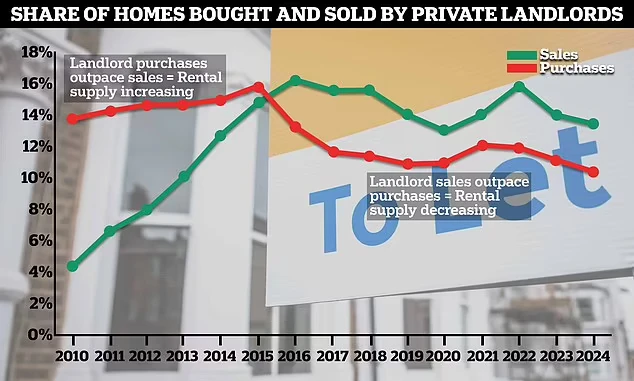

Last year, 10,896 homes were sold through Right to Buy while only 3,447 were replaced, resulting in a net loss of 7,449. Since 1991, the scheme has resulted in the loss of 24,000 social homes, according to official figures.

Under Right to Buy, which was introduced in 1980 as one of Mrs Thatcher’s flagship reforms, the government sells off council housing at discounts of up to £102,400 to sitting tenants, rising to £136,400 in London.

Rayner acquired her council house using the Right to Buy scheme in 2007 with a 25% discount, making a reported £48,500 profit when selling it, albeit eight years later.

A Ministry of Housing, Communities and Local Government spokesperson recently said: “Right to Buy remains an important route for council housing tenants to be able to buy their own home but it’s scandalous that only a third of council homes sold under the scheme have been replaced since 2012.

“Increasing protections on newly-built social homes will be looked at as part of our wider review but there are no plans to abolish the Right to Buy scheme.”

Original Post: https://propertyindustryeye.com